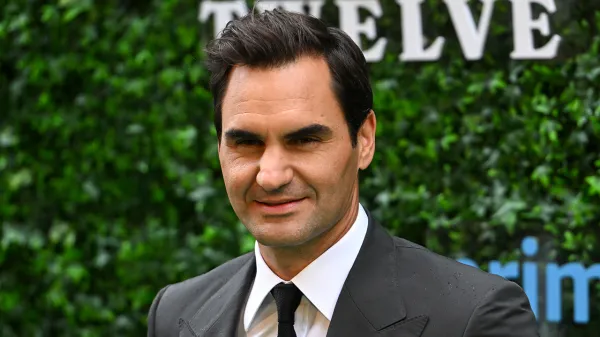

Roger Beit Net Worth: A Look at His Wealth in 2023

Roger Beit Net Worth: A Look at His Wealth in 2023 has become a focal point of interest, particularly due to his adept navigation of complex market dynamics and his diverse investment portfolio. With significant holdings in real estate and a keen eye for emerging technology startups, Beit’s financial strategies reflect a commitment to sustainability and innovation. As economic landscapes shift, the implications of his investment choices raise critical questions about future wealth trajectories. What factors will ultimately determine the sustainability of his wealth in the coming years?

Overview of Roger Beit

Roger Beit Net Worth: A Look at His Wealth in 2023 is frequently recognized as a prominent figure in the finance and investment sectors, known for his strategic insights and innovative approaches to wealth management.

His biography reflects a career marked by significant achievements, including the establishment of successful investment frameworks.

Beit’s analytical acumen and commitment to client autonomy have solidified his reputation as a leader dedicated to empowering investors in their financial journeys.

Read more: Kyle Seager Net Worth: Former MLB Player’s Earnings Breakdown

Sources of Wealth

A comprehensive understanding of Roger Beit’s wealth reveals multiple streams contributing to his financial success.

His portfolio encompasses real estate holdings and investments in tech startups, illustrating strategic market diversification.

Additionally, Beit manages extensive investment portfolios and luxury assets, while engaging in philanthropic efforts that reflect his values.

His approach to wealth management also includes alternative investments, ensuring robust financial growth.

Key Investments

Key investments play a pivotal role in Roger Beit’s financial portfolio, reflecting his acumen in identifying lucrative opportunities across various sectors.

His strategic asset allocation includes real estate, tech startups, and private equity, showcasing a commitment to sustainable investing.

Through meticulous market analysis and venture capital investments, Beit effectively manages wealth, positioning himself for continued growth in an evolving economic landscape.

Business Ventures

Leveraging his extensive experience in various industries, Beit has successfully launched and managed a diverse array of business ventures that underscore his entrepreneurial spirit.

His investments in real estate have yielded substantial returns, while his involvement in technology startups showcases his commitment to innovation.

Financial Strategies

Navigating the complexities of personal finance, Roger Beit has employed a range of financial strategies that reflect both prudence and foresight.

His approach to wealth management emphasizes financial literacy, incorporating robust investment portfolios and thorough risk assessments.

Market Trends Impacting Wealth

Market trends significantly influence wealth accumulation and management strategies.

Economic factors, such as inflation rates and interest fluctuations, shape investor behavior and asset allocation decisions.

As a result, understanding evolving investment strategies is crucial for navigating the current financial landscape effectively.

Economic Factors Overview

Amidst fluctuating economic conditions, various market trends have significantly influenced individual wealth accumulation in 2023.

Inflation effects have eroded purchasing power, compelling investors to seek alternative assets.

Concurrently, global markets exhibit volatility, driven by geopolitical tensions and supply chain disruptions.

These dynamics necessitate a keen understanding of economic indicators, as individuals navigate an increasingly complex landscape to safeguard and grow their wealth.

Investment Strategies Evolving Trends

In 2023, investors are increasingly adapting their strategies to align with rapidly evolving market trends that significantly impact wealth accumulation.

Emphasizing diversified portfolios allows for greater resilience against market fluctuations while enhancing growth potential.

Moreover, robust risk management practices are essential to navigate uncertainties, enabling investors to safeguard their assets and optimize returns in a landscape characterized by volatility and shifting economic dynamics.

Future Projections

Frequently, analysts speculate on the future trajectory of Roger Beit’s net worth, considering various factors such as market trends, investment strategies, and economic conditions.

The future outlook for his wealth accumulation may hinge on:

- Innovative investment ventures

- Market volatility management

- Diversification of assets

- Global economic shifts

These elements could significantly influence Beit’s financial landscape in the coming years.

Read more: Kylie Rocket Net Worth: $1 Million (Adult Film Actress)

Conclusion

In conclusion, Roger Beit Net Worth: A Look at His Wealth in 2023 financial portfolio resembles a well-tended garden, flourishing through careful selection and nurturing of diverse investments. The strategic focus on sustainable practices and innovative sectors positions Beit favorably amidst economic uncertainties. As market dynamics continue to evolve, the potential for growth remains robust, supported by astute risk management and an unwavering commitment to diversification. Future projections indicate that Beit’s wealth may expand further, reflecting the resilience and adaptability of his investment approach.